Heavy vs Light Crude Oil: 5 Critical Trading Differences

Understanding the distinction between heavy vs light crude oil is essential for refinery operators, petroleum traders, and supply chain professionals navigating global energy markets. API gravity classification determines refinery complexity requirements, product yield structures, and ultimately commercial profitability. This analysis explores five critical differences that impact procurement strategies, processing costs, and downstream petrochemical production for B2B decision-makers in the energy sector.

Table of Contents

1. API Gravity Classification and Density Parameters

The fundamental difference between heavy vs light crude oil lies in API gravity measurement standardized by the American Petroleum Institute. Light crude oil exceeds 31.1° API, indicating lower density and higher market desirability. Heavy crude oil falls below 22.3° API, representing denser molecular structures requiring advanced refining technologies.

Medium crude oil occupies the 22.3–31.1° API range, balancing processing economics with yield optimization. API gravity inversely correlates with specific gravity: higher API values indicate lighter, more valuable crude grades. This classification directly impacts crude oil specifications for international trade contracts and refinery feedstock selection strategies.

- Light Crude: 31.1–50° API, flows easily at ambient temperature

- Medium Crude: 22.3–31.1° API, moderate viscosity characteristics

- Heavy Crude: 10–22.3° API, requires heating for transportation

- Extra Heavy: Below 10° API, bitumen-like properties

2. Refinery Processing Requirements and Complexity

Refineries process heavy vs light crude oil through distinctly different technological pathways affecting capital investment and operational expenditure. Light crude requires simple atmospheric distillation and basic hydrotreating units, making it suitable for topping refineries with minimal complexity. Heavy crude demands coking units, hydrocracking systems, and advanced desulfurization technologies.

The Nelson Complexity Index quantifies refinery sophistication needed for different crude grades. Light sweet crude processing achieves complexity ratings of 5–7, while heavy sour crude requires indexes exceeding 10–12. According to the U.S. Energy Information Administration, refineries configured for heavy crude command premium processing margins when light-heavy crude price differentials widen.

| Parameter | Light Crude Oil | Heavy Crude Oil |

|---|---|---|

| API Gravity | 31.1–50° | 10–22.3° |

| Sulfur Content | 0.1–0.5% (Sweet) | 1.5–3.5% (Sour) |

| Refinery Complexity | Low (NCI 5–7) | High (NCI 10–12) |

| Gasoline Yield | 45–50% | 25–30% |

| Price Differential | Benchmark +$5–15/bbl | Benchmark -$10–25/bbl |

3. Product Yield Structure and Market Value

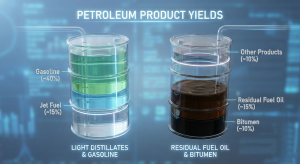

The economic case for heavy vs light crude oil procurement centers on product slate optimization and margin realization. Light crude naturally yields 45–50% gasoline and naphtha, maximizing production of high-value transportation fuels. Heavy crude generates 25–30% gasoline but produces substantial quantities of residual fuel oil and petroleum coke.

Advanced coking and hydrocracking enable heavy crude refineries to upgrade bottom-of-barrel fractions into middle distillates. This processing flexibility becomes strategically valuable when diesel fuel demand exceeds gasoline consumption in emerging markets. Petrochemical feedstock production from heavy crude includes higher aromatics content suitable for BTX extraction.

Comparative Yield Structures

- Light Crude Products: Maximum gasoline (45%), jet fuel (12%), diesel (25%)

- Heavy Crude Products: Moderate gasoline (28%), diesel (30%), residual fuel (20%)

- Refinery Margins: Light crude $8–12/bbl, Heavy crude $12–18/bbl (complex refineries)

- Petrochemical Integration: Heavy crude favors aromatic production pathways

4. Pricing Mechanisms and Trading Benchmarks

Global heavy vs light crude oil pricing follows distinct benchmark systems reflecting regional supply-demand dynamics. West Texas Intermediate (WTI) and Brent represent light sweet crude references, while Dubai/Oman and Western Canadian Select benchmark heavy grades. Quality differentials typically range $15–30 per barrel depending on API gravity and sulfur specifications.

Platts and Argus publish daily assessments capturing these differentials through transparent pricing methodologies. The light-heavy crude spread widens when refinery utilization rates increase or when environmental regulations favor low-sulfur fuel production. Understanding oil benchmark differences enables traders to optimize arbitrage opportunities across global markets.

5. Global Trade Flows and Supply Chain Logistics

International trade patterns for heavy vs light crude oil reflect transportation infrastructure and refinery configuration geography. Light crude moves efficiently through standard pipelines and VLCC tankers without heating requirements. Heavy crude necessitates diluent blending, heated storage systems, and specialized vessel coatings to maintain flowability.

Major heavy crude exporters include Venezuela, Canada, and Mexico, targeting complex refineries in the U.S. Gulf Coast and Asian markets. Light crude dominates Middle Eastern exports serving European and Asian simple refineries. Supply chain professionals must account for viscosity management, transportation cost premiums of $3–8 per barrel, and compatibility with existing regional refinery infrastructure.

Logistics Considerations

- Transportation Costs: Heavy crude incurs 20–40% premium for heating and diluents

- Storage Requirements: Heated tanks mandatory for heavy grades below 15° API

- Blending Operations: Heavy crude often mixed with condensates for pipeline flow

- Documentation Standards: HS Code 2709 covers crude petroleum trade specifications

Conclusion

The strategic choice between heavy vs light crude oil procurement fundamentally shapes refinery economics, product portfolios, and competitive positioning in global energy markets. Light crude offers processing simplicity and premium gasoline yields, while heavy crude provides margin opportunities for sophisticated refineries with conversion capabilities. B2B decision-makers must evaluate API gravity specifications, sulfur content, refinery complexity requirements, yield structures, and logistics constraints when structuring crude supply agreements.

Market intelligence indicates growing heavy crude discount opportunities as light tight oil production expands globally. Refineries investing in coking and hydrocracking technologies position themselves to capture widening light-heavy crude spreads while meeting evolving international petroleum standards. Supply chain optimization requires balancing crude acquisition costs against processing expenses and ultimate product realization values in target markets.

Optimize Your Crude Oil Supply Strategy

Petro Eghlima delivers tailored heavy vs light crude oil procurement solutions for refineries and traders worldwide. Our technical team provides detailed assay analysis, logistics coordination, and market intelligence supporting informed sourcing decisions.

Contact our energy trading desk for competitive pricing and reliable supply: Petro Eghlima