LPG Market Analysis: 7 Critical Insights for Success

Global demand for liquefied petroleum gas continues to reshape international supply chains and trade dynamics. This comprehensive LPG market analysis delivers actionable insights for traders, importers, manufacturers, and procurement managers navigating regional variations across Asia, Europe, and the Americas. Understanding price volatility, consumption patterns, and export flows enables strategic positioning in this $100+ billion global market.

Table of Contents

Regional Pricing Dynamics and Benchmark Structures

Asian premiums historically reflect tighter supply-demand balances and longer transportation routes. European markets demonstrate greater price stability due to established pipeline networks and strategic storage facilities. Understanding digital oil trading platforms enhances price discovery and transaction efficiency across regions.

Seasonal fluctuations impact pricing differently by geography. Winter heating demand elevates European and Northeast Asian prices, while petrochemical demand drives summer peaks in Gulf Coast markets. Currency movements and freight rates add complexity to international LPG market analysis.

Comparative Price Table by Region (Q4 2024)

| Region | Average Price (USD/MT) | Primary Benchmark | Volatility Index |

|---|---|---|---|

| Asia-Pacific | 585-620 | Saudi CP / FEI | High |

| Europe | 550-590 | CIF ARA | Moderate |

| North America | 480-530 | Mont Belvieu | Low-Moderate |

Demand Patterns Across Three Major Markets

Asia-Pacific dominates global LPG consumption, accounting for approximately 45% of worldwide demand. Residential cooking, transportation fuel, and petrochemical feedstock represent primary end-uses. China and India lead regional consumption growth driven by urbanization and infrastructure development.

European demand centers on residential heating in off-grid rural areas and chemical manufacturing applications. The continent’s energy transition policies influence long-term demand trajectories. Industrial users increasingly evaluate LPG versus LNG alternatives for operational optimization.

North American consumption reflects robust petrochemical sector activity and expanding export capabilities. The United States transformed from net importer to major exporter following shale gas production growth. Propane dehydrogenation units and ethylene crackers drive industrial demand patterns.

Key Demand Drivers by Application:

- Residential Sector: Cooking fuel in developing markets, heating in temperate zones

- Transportation: Autogas adoption varies significantly by region

- Petrochemical Feedstock: Propylene production for plastics manufacturing

- Industrial Applications: Metal cutting, agriculture drying, hospitality services

Export Value and Trade Flow Analysis

International trade volumes exceed 90 million metric tons annually. The United States emerged as the world’s largest exporter, shipping significant volumes to Asian and European buyers. Middle Eastern producers maintain substantial market share through long-term contracts.

Export values fluctuate based on crude oil prices and regional supply-demand imbalances. HS Code 2711.13 (propane) and 2711.14 (butanes) govern customs classifications. Freight costs represent significant price components for cross-continental shipments. According to U.S. Energy Information Administration data, transportation logistics influence delivered pricing substantially.

Supply Chain Infrastructure and Logistics

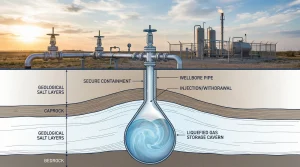

Infrastructure maturity varies dramatically across regions. Europe benefits from extensive pipeline networks, underground storage caverns, and coastal import terminals. Asian markets continue developing receiving facilities to accommodate growing demand.

North American export infrastructure expanded rapidly over the past decade. New terminals along Gulf Coast and East Coast locations enable efficient loading operations. Storage capacity influences price volatility and supply security during disruptions. Terminal operators provide critical services including blending and quality testing.

Regulatory Landscape and Quality Standards

Quality specifications differ by market and application. ASTM D1835 governs North American propane standards, while ISO 9162 provides international guidelines. European markets reference EN 589 for automotive LPG.

Safety regulations impact transportation, storage, and handling procedures. International Maritime Organization codes govern marine transport. Understanding petroleum product standards prevents costly delays and contractual disputes.

Compliance Considerations:

- Product composition specifications and propane/butane ratios

- Vapor pressure limits and testing protocols

- Sulfur content restrictions varying by jurisdiction

- Transportation safety requirements and vessel certification

Market Outlook and Strategic Implications

Long-term projections indicate continued Asian demand growth, particularly in Southeast Asian and South Asian markets. Infrastructure investments and economic development support consumption increases. Strategic suppliers position themselves through flexible supply agreements.

European markets face transition uncertainties as renewable energy adoption accelerates. LPG maintains advantages as a lower-carbon alternative during interim periods. North American export capacity expansion continues through 2026, potentially reshaping global trade flows. Market participants must monitor geopolitical developments affecting international commerce.

Conclusion

This comprehensive LPG market analysis reveals distinct regional characteristics requiring tailored commercial approaches. Price mechanisms, demand drivers, and regulatory frameworks create unique challenges across Asia, Europe, and North America. Successful traders leverage market knowledge, logistics networks, and strategic partnerships.

Understanding comparative advantages by region enables informed procurement decisions. Whether sourcing feedstock for petrochemical operations or securing residential supply contracts, market intelligence drives competitive positioning. Professional buyers must maintain current awareness through continuous monitoring and expert analysis.

Partner with Petro Eghlima for Strategic LPG Market Analysis

Petro Eghlima delivers competitive pricing, reliable logistics, and transparent transactions for global LPG buyers and sellers. Our market intelligence supports informed decision-making across Asia, Europe, and the Americas. We are ready to engage with genuine and loyal buyers.

Contact our trading desk today to discuss your LPG market analysis requirements, pricing inquiries, and long-term supply agreements.

Reach out now: Visit Petro Eghlima for immediate assistance with international LPG procurement.