AI in Oil Trading: 7 Game-Changing Industry Insights

The integration of AI in oil trading is revolutionizing how global petrochemical markets operate. Artificial intelligence now drives critical decision-making processes across supply chains, from crude oil procurement to refined product distribution. For traders, importers, and procurement managers, understanding these technological advancements delivers competitive advantages in pricing accuracy, risk management, and operational efficiency.

Modern petroleum trading demands real-time data processing capabilities that traditional methods cannot provide. AI-powered platforms analyze millions of market signals simultaneously, identifying arbitrage opportunities and supply disruptions before human analysts detect them. This transformation affects every stakeholder in the global energy ecosystem.

Table of Contents

- 1. Predictive Price Modeling and Market Forecasting

- 2. Supply Chain Optimization and Logistics Intelligence

- 3. Advanced Risk Assessment and Compliance Monitoring

- 4. Automated Quality Control and Specification Verification

- 5. Algorithmic Trading and Execution Strategies

- 6. Real-Time Market Intelligence and Sentiment Analysis

- 7. Sustainability Tracking and Carbon Footprint Analysis

- Conclusion

1. Predictive Price Modeling and Market Forecasting

Machine learning algorithms now process historical pricing data from major oil trading hubs alongside geopolitical events, weather patterns, and production reports. These systems identify correlations invisible to conventional analysis methods. Traders utilizing AI-driven forecasting tools report 15-30% improvement in pricing accuracy compared to traditional fundamental analysis approaches.

Advanced neural networks incorporate multiple data streams including OPEC announcements, refinery maintenance schedules, and shipping route disruptions. The technology enables scenario modeling that evaluates hundreds of market variables simultaneously. Leading trading desks now rely on these predictive capabilities for contract negotiations and hedging strategies.

Key Applications in Price Forecasting

- Crude oil benchmark prediction: AI models analyze WTI, Brent, and Dubai crude differentials with unprecedented precision

- Refined product spreads: Automated systems track crack spread movements across regional markets

- Seasonal demand patterns: Machine learning identifies consumption trends for products like LPG and diesel fuel

- Arbitrage opportunity detection: Real-time algorithms spot price discrepancies between international trading terminals

2. Supply Chain Optimization and Logistics Intelligence

AI systems transform petroleum supply chain management by optimizing vessel routing, storage allocation, and inventory management. These platforms integrate AIS vessel tracking data with port congestion metrics and weather forecasting to recommend optimal shipping schedules. The result is reduced demurrage costs and improved delivery reliability.

Procurement teams leverage AI to evaluate supplier performance across quality consistency, delivery timelines, and pricing competitiveness. The technology automatically flags deviations from contractual specifications, enabling proactive quality management. This capability proves particularly valuable when sourcing complex products with strict ASTM or ISO specifications.

| Supply Chain Function | Traditional Method | AI-Enhanced Method |

|---|---|---|

| Route Planning | Manual analysis, 2-3 day lead time | Real-time optimization, instant updates |

| Inventory Management | Periodic reviews, 10-15% safety stock | Predictive restocking, 5-8% safety stock |

| Supplier Evaluation | Quarterly performance reports | Continuous scoring with automated alerts |

3. Advanced Risk Assessment and Compliance Monitoring

Regulatory compliance in petroleum trading involves navigating complex international standards, sanctions screening, and documentation requirements. AI platforms monitor regulatory changes across jurisdictions, automatically updating compliance protocols. These systems cross-reference transaction data against sanctioned entities lists, reducing legal exposure for trading organizations.

Credit risk assessment benefits significantly from machine learning models that evaluate counterparty financial health using alternative data sources. AI analyzes payment histories, corporate filings, and market sentiment to generate dynamic risk scores. This capability enables more informed credit limit decisions and reduces default rates.

4. Automated Quality Control and Specification Verification

Quality assurance represents a critical component of petroleum product trading. AI-powered spectroscopy analysis provides instant verification of product specifications against industry standards. These systems detect adulteration or contamination that might compromise product quality, protecting buyers from substandard shipments.

Digital certificates of analysis undergo automated validation through blockchain-integrated AI platforms. The technology verifies laboratory credentials, test method compliance, and specification alignment with contractual requirements. This process reduces disputes and accelerates cargo clearance at discharge terminals.

Specification Parameters Monitored by AI Systems

- Sulfur content verification: Critical for EN590 diesel and marine fuel compliance

- Octane and cetane number validation: Ensures motor fuel performance standards

- Distillation curve analysis: Verifies refinery cut points for various petroleum fractions

- Density and API gravity checks: Confirms crude oil grade classifications

5. Algorithmic Trading and Execution Strategies

High-frequency trading algorithms execute petroleum futures and derivatives transactions within milliseconds. These systems capitalize on micro-price movements across exchanges, generating returns through volume-based strategies. According to the U.S. Energy Information Administration, algorithmic trading now accounts for over 60% of daily crude oil futures volume.

Smart order routing algorithms determine optimal execution venues by analyzing liquidity depth, transaction costs, and market impact. The technology splits large orders across multiple platforms to minimize price slippage. This capability proves essential for institutional traders managing significant cargo volumes.

6. Real-Time Market Intelligence and Sentiment Analysis

Natural language processing engines scan thousands of news sources, social media channels, and industry publications to gauge market sentiment. These AI systems identify emerging trends before they reflect in price movements. Traders receive alerts on geopolitical developments, production disruptions, or policy changes affecting petroleum markets.

Sentiment analysis algorithms evaluate the tone and context of industry reports, earnings calls, and regulatory announcements. This intelligence informs trading strategies by providing early indicators of supply-demand shifts. The technology complements traditional fundamental analysis with behavioral market insights.

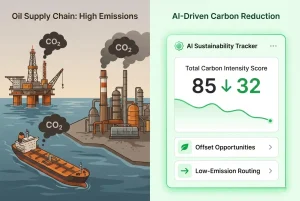

7. Sustainability Tracking and Carbon Footprint Analysis

Environmental regulations increasingly influence petroleum trading decisions. AI platforms calculate the carbon intensity of supply chains, enabling buyers to select lower-emission sourcing options. These systems track emissions from extraction through transportation and refining, providing comprehensive lifecycle assessments.

Carbon credit optimization algorithms help trading companies balance regulatory compliance with cost efficiency. The technology identifies opportunities to offset emissions through verified carbon markets while maintaining competitive pricing structures. This capability becomes critical as jurisdictions implement stricter environmental standards.

Conclusion

The application of AI in oil trading fundamentally transforms how global petroleum markets function. From predictive analytics and supply chain optimization to compliance monitoring and sustainability tracking, artificial intelligence delivers measurable improvements across trading operations. Organizations that integrate these technologies gain significant competitive advantages through enhanced decision-making speed, accuracy, and risk management capabilities.

As machine learning models become more sophisticated and data sources expand, the role of AI in petroleum trading will continue growing. Traders, procurement managers, and supply chain professionals must understand these technological developments to maintain market relevance. The future of energy commodity trading belongs to organizations that effectively combine human expertise with artificial intelligence capabilities.

Partner with Petro Eghlima for Advanced Oil Trading Solutions

Leverage our expertise in global petroleum markets enhanced by cutting-edge AI in oil trading technologies. Our team provides competitive pricing, reliable supply chains, and technical support for your procurement needs.

We are ready to engage with genuine and loyal buyers.